IRS Expands List of Notices Paused Due to Processing Backlog

After implementing a freeze limited to a single notice on January 27[1] the IRS was criticized from many quarters, including the AICPA,[2] for taking such a limited action. The IRS has now announced they will be adding a number of other notices to put on pause while the IRS attempts to catch up on processing the backlog that already exists.[3]

The IRS news release begins by stating:

As part of ongoing efforts to provide additional help for people during this period, the IRS announced today the suspension of more than a dozen additional letters, including the mailing of automated collection notices normally issued when a taxpayer owes additional tax, and the IRS has no record of a taxpayer filing a tax return.

These mailings include balance due notices and unfiled tax return notices. The IRS entered this filing season with several million original and amended returns filed by individuals and businesses that have not been processed due to challenges of the historic pandemic and is taking this step to help avoid confusion for taxpayers and tax professionals.[4]

The IRS does not provide an end date for the pause, noting:

These automatic notices have been temporarily stopped until the backlog is worked through. The IRS will continue to assess the inventory of prior year returns to determine the appropriate time to resume the notices.[5]

The IRS warns that this cessation of notices does not mean that the taxpayer or adviser may not continue to receive notices for a period of time:

Some taxpayers and tax professionals may still receive these notices during the next few weeks. Generally, there is no need to call or respond to the notice as the IRS continues to process prior year tax returns as quickly as possible.[6]

But the IRS goes on to state that if the taxpayer and/or adviser believes the notice is accurate, they should take action to deal with the situation:

However, if a taxpayer or tax professional believes a notice is accurate, they should act to rectify the situation for the well-being of the taxpayer. For example, the IRS cautions people with a balance due that interest and penalties can continue to accrue. In addition, IRS employees may in select circumstances issue notices to particular taxpayers to resolve specific compliance issues.[7]

While not emphasized as much as in the earlier notice, the IRS does continue to note that some notices are required to be issued based on a deadline and will continue to be issued:

The IRS does not have the authority to stop all notices as many are legally required to be issued within a certain timeframe. The IRS will continue to assess other changes and system modifications that the IRS may be able to implement to assist taxpayers on an array of issues. The IRS will continue to make information available to taxpayers throughout the filing season.[8]

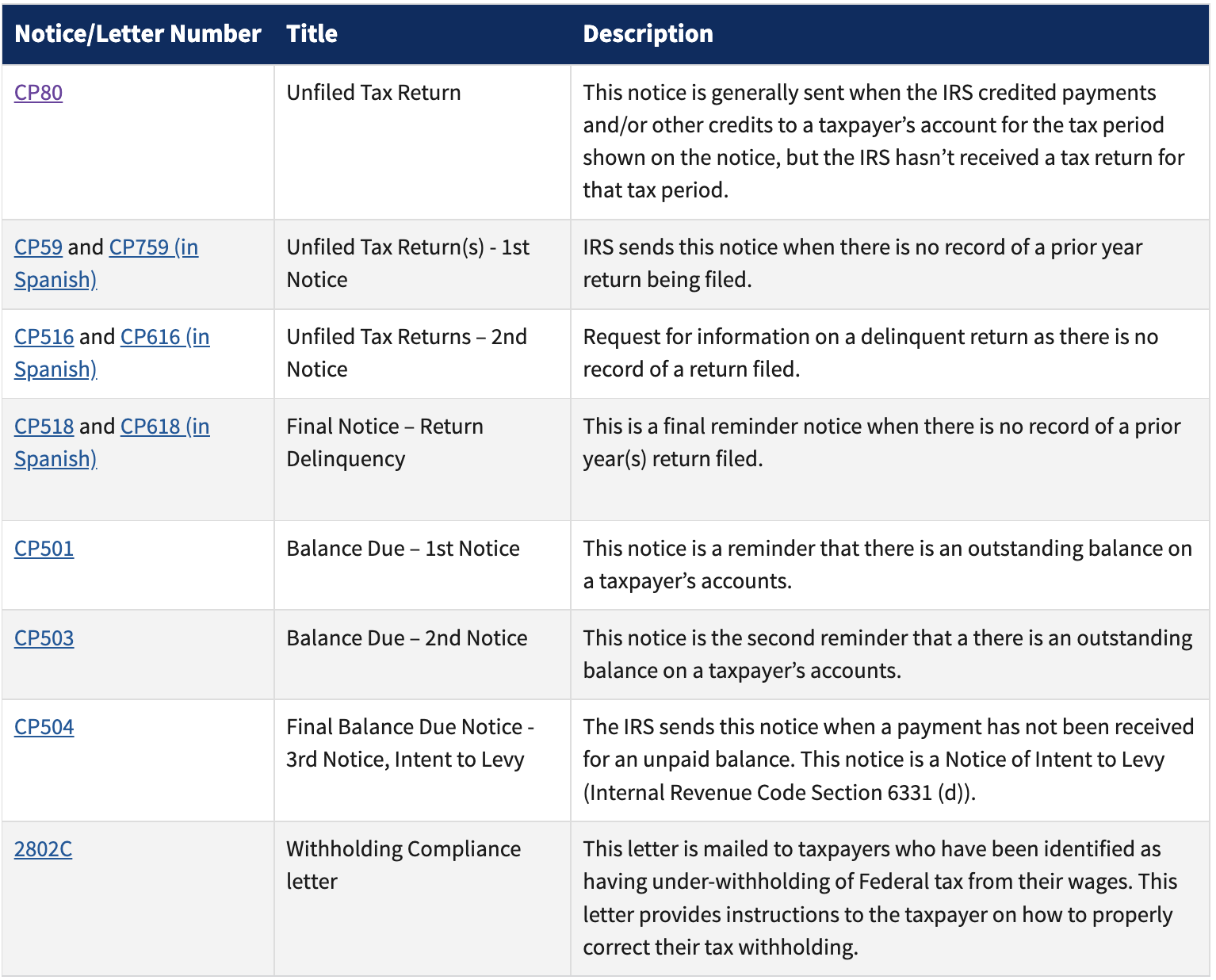

The News Release concludes with a table of notices that are covered by this suspension.

Individual Taxpayer Notices

Business Notices

[1] Ed Zollars, “IRS Will Suspend the Mailing of Automated Notices About Taxpayers Not Filing a 2020 Return for Which the IRS Has a Payment,” Current Federal Tax Developments website, January 27, 2022, https://www.currentfederaltaxdevelopments.com/blog/2022/1/27/irs-will-suspend-the-mailing-of-automated-notices-about-taxpayers-not-filing-a-2020-return-for-which-the-irs-has-a-payment (retrieved February 12, 2022)

[2] Ed Zollars, “AICPA Releases Response to IRS Announcement on Relief for Automated Notices,” Current Federal Tax Developments website, January 27, 2022, https://www.currentfederaltaxdevelopments.com/blog/2022/1/27/aicpa-releases-response-to-irs-announcement-on-relief-for-automated-notices (retrieved February 12, 2022)

[3] “IRS continues work to help taxpayers; suspends mailing of additional letters,” IRS News Release 2022-31, February 9, 2022, https://www.irs.gov/newsroom/irs-continues-work-to-help-taxpayers-suspends-mailing-of-additional-letters (retrieved February 12, 2022)

[4] “IRS continues work to help taxpayers; suspends mailing of additional letters,” IRS News Release 2022-31, February 9, 2022

[5] “IRS continues work to help taxpayers; suspends mailing of additional letters,” IRS News Release 2022-31, February 9, 2022

[6] “IRS continues work to help taxpayers; suspends mailing of additional letters,” IRS News Release 2022-31, February 9, 2022

[7] “IRS continues work to help taxpayers; suspends mailing of additional letters,” IRS News Release 2022-31, February 9, 2022

[8] “IRS continues work to help taxpayers; suspends mailing of additional letters,” IRS News Release 2022-31, February 9, 2022