IRS Announces Depreciation and Lease Inclusion Amounts on Vehicles for 2023

In Revenue Procedure 2023-14[1] the IRS has released the depreciation limits on automobiles under IRC §280F for 2023.

Table 1[2] applies to passenger automobiles acquired by the taxpayer after September 27, 2017, and placed in service by the taxpayer during calendar year 2023, for which the §168(k) additional first year depreciation deduction applies. The maximum depreciation deduction allowed for each year is as follows:

Table 1

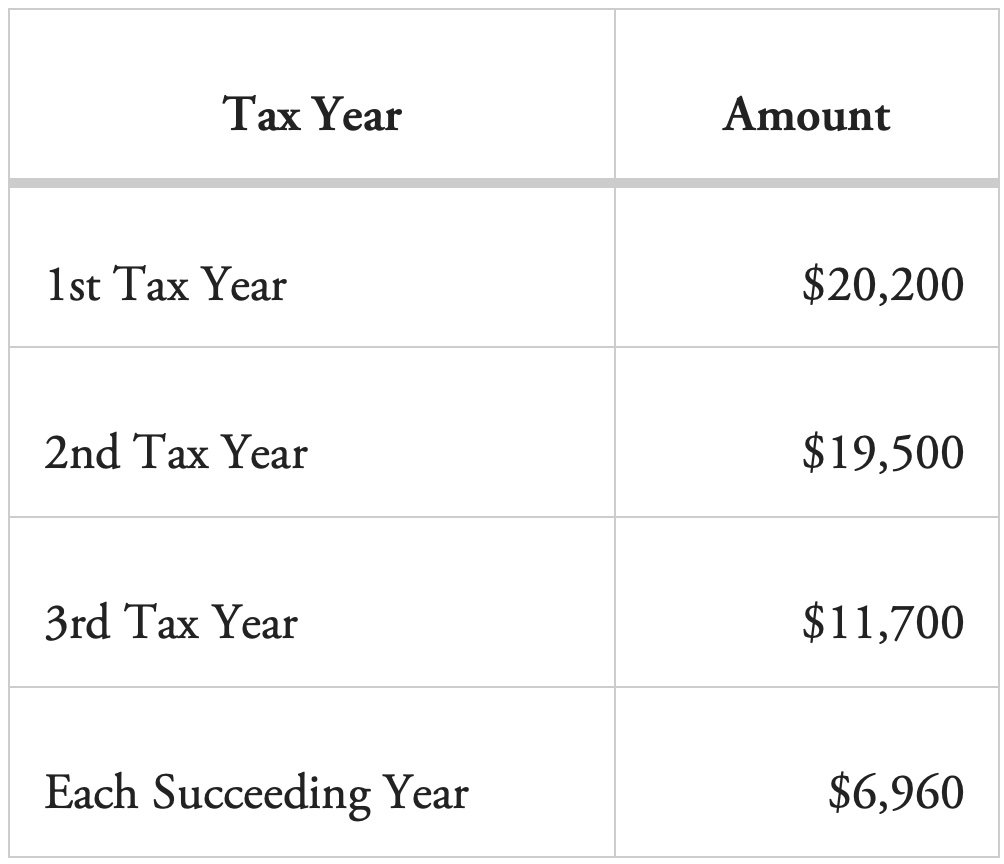

Table 2[3] applies to passenger automobiles placed in service by the taxpayer during calendar year 2023 for which no §168(k) additional first year depreciation deduction applies. The maximum depreciation deduction allowed for each year is as follows:

Table 2

The Revenue Procedure also provides Table 3, which provides the dollar amount used by lessees of passenger automobiles with a lease term beginning in 2023 to determine the income inclusion amount for those passenger automobiles.[4]

[1] Revenue Procedure 2013-14, January 18, 2023, https://www.irs.gov/pub/irs-drop/rp-23-14.pdf (retrieved January 20, 2023)

[2] Revenue Procedure 2013-14, January 18, 2023

[3] Revenue Procedure 2013-14, January 18, 2023

[4] Revenue Procedure 2013-14, January 18, 2023